FAQs

TAX PREPARATION

Common Questions on Tax Preparation

Find Your Questions Here

When is the due date to file my income tax return or extension form?

The deadline to file your 2023 tax return or extension is April 18, 2024, due to the Emancipation Day holiday in D.C. For Maine and Massachusetts residents, the deadline is April 19, 2024, due to Patriots' Day.

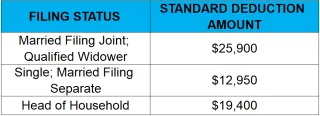

What are the standard deduction amounts for the 2023 tax season?

For the 2023 tax season, the standard deduction amounts have increased slightly. For 2022 tax returns, these amounts help more people avoid itemizing deductions on Schedule A.

Is the personal exemption still at $0 as it was in 2020?

The personal exemption for the 2023 tax year is still $0, as it was in 2020, due to the Tax Cuts and Jobs Act.

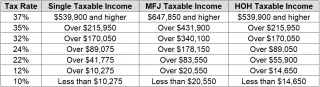

What is the top tax rate, and how do the tax rates vary based on different taxable income levels?

For the 2023 tax year, the top tax rate remains at 37%. Other rates vary based on taxable income levels.

Is there any limitation on itemized deductions for tax returns?

There are no limitations on itemized deductions for the 2023 tax returns, continuing the trend from 2018 to 2021, as per the Tax Cuts and Jobs Act.

What is the (AMT) Alternative Minimum Tax exemption?

The AMT exemption is $75,900 for single filers and $118,100 for married filing jointly. Phase-outs begin at $539,900 and $1,079,800, respectively.

What are the HSA contribution limits for both single and family coverage?

HSA contribution limits are $3,650 for individuals with single coverage and $7,300 for family coverage.

What are the changes in the Child Tax Credit?

Child Tax Credit is $2,000 per qualifying child. The refundable portion is up to $1,500. The age limit for qualifying children is under 17. No advance payments were issued in 2022.

What are the key changes to the Child and Dependent Care Credit?

Child and Dependent Care Credit is non-refundable, with a maximum credit of 35%. Eligible expenses are up to $3,000 for one dependent and $6,000 for multiple dependents.

What are the key details of the new Clean Vehicle Credit for electric vehicles?

Starting January 1, 2023, you can get up to $7,500 for new electric vehicles and up to $4,000 for used ones. The final assembly must be in North America to qualify.

Will there be a recovery rebate credit available for claiming unreceived stimulus payments in 2022?

There were no stimulus payments in 2022, so no Recovery Rebate Credit is available for that year.

Can non-itemizers claim charitable deductions?

Without an extension, charitable deductions can only be claimed by itemizing on Schedule A.

Are there any changes to the Earned Income Tax Credit (EITC) age limits?

EITC age limits revert to pre-2021 rules, excluding those 65+ and 19-24 without children. The investment income limit is $10,300.

What is the maximum deduction that teachers can claim for out-of-pocket expenses?

Teachers can deduct up to $300 for out-of-pocket expenses.

Is the unemployment exclusion income still applicable?

The $10,200 unemployment income exclusion applied only to 2020. All 2023 unemployment benefits are taxable.

Has the deduction for charitable contribution been extended ?

Charitable contribution deduction is $300 per individual, $600 for joint filers. The 60% AGI limit for charitable contributions is suspended.

Is forgiven student loan debt for post-secondary education taxable ?

Most forgiven student loan debt is not taxable. Employers can exclude up to $5,250 for student loan repayment from taxable wages through 2025.

What is the gift tax exclusion?

Gift tax exclusion is $15,000 per recipient, $30,000 for couples. The lifetime estate and gift tax exemption is $11.7 million, $23.4 million for couples.

Is the Tuition & Fees Deduction eliminated ?

The Tuition & Fees Deduction is eliminated in 2022. The phase-out thresholds for the Lifetime Learning credit now match the American Opportunity credit.

What does it mean for individuals who received an excess premium tax credit?

Any excess premium tax credits received must be repaid when filing your tax return.

Are there changes to the Form 1099-K reporting requirements ?

Third-party networks like PayPal must issue a 1099-K for payments over $600 for goods or services, regardless of transaction count.

Website and Email

Email:

info@elitistsolutions.com

Website

www.elitistsolutions.com

Get In Touch

Assistance Hours

Mon – Fri 9:00am – 8:00pm

Saturday 10:00 am – 2:00 pm

Sunday – CLOSED

Phone Number:

(470) 536-9197

Call (470) 536-9197

Email: info@elitistsolutions.com

Site: www.elitistsolutions.com